Jarrett Keohokalole Talks About HECO 'Sell-Out' And Condo Insurance Rescue

The Senate Commerce chair was in the middle of some of the Legislature’s most contentious issues.

By Chad Blair

June 8, 2025 · 26 min read

About the Author

Chad Blair is the politics editor for Civil Beat. You can reach him by email at cblair@civilbeat.org or follow him on X at @chadblairCB.

The Senate Commerce chair was in the middle of some of the Legislature’s most contentious issues.

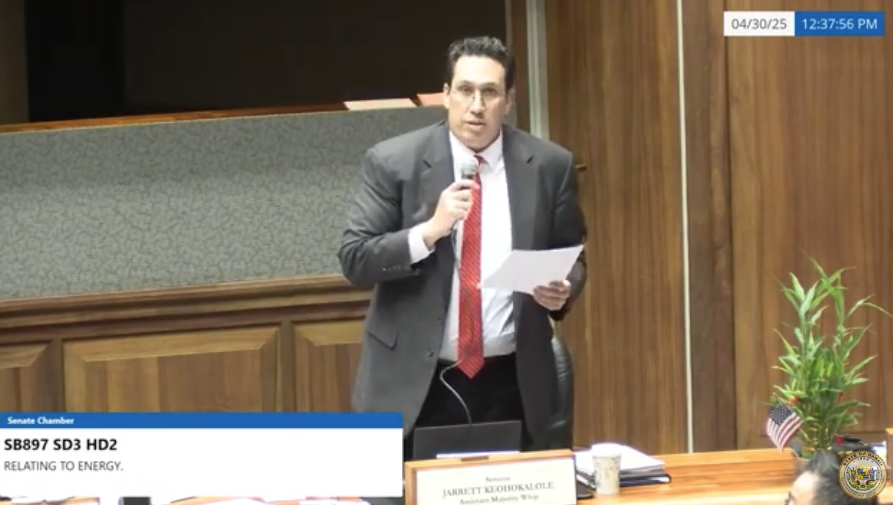

Sen. Jarrett Keohokalole is often at the center of critical and controversial issues at the Legislature, which last session included bills on condominium insurance, invasive species, Hawaiian Electric Co. and Hawaiian homelands.

Unlike many of his colleagues, he is not shy about speaking out, such as repeatedly finding fault with the state Department of Agriculture for not doing enough to combat little fire ants or proposing a casino for the Department of Hawaiian Home Lands to help place Native Hawaiian beneficiaries in homes.

Keohokalole’s willingness to stand out was perhaps most evident late last session when he delivered a 12-minute floor speech denouncing a bill that he argued helped Hawaiian Electric Co. at the expense of ratepayers and could potentially place all citizens at risk in the wake of the devastating 2023 Lahaina wildfires.

The bill had been amended at the last minute without public input, Keohokalole said, to give the Public Utilities Commission “the unilateral power” to cap HECO’s liability if it causes another wildfire. He said it boiled down to the Legislature outsourcing its constitutional authority to an unelected commission.

“It’s a blatant corporate handout, and we’re being asked to make this precedent-setting decision without full awareness of what it really means. Why the urgency?” Keohokalole said. “Let me say this clearly, this bill is not a bailout. You bail people out of a crisis. HECO’s not in a crisis. They have bad credit. That’s the problem.”

“So let’s call this what it is. It’s not a bailout. It’s a sell-out. This bill was originally drafted to protect the people from HECO. Now it protects HECO from the people.”

Those were strong words directed against one of the most powerful and politically entrenched entities in the state. Senate Bill 897 passed and is expected to become law, but five senators and 10 House representatives voted against it.

Keohokalole, who represents Kāneʻohe and Kailua, is chair of the Commerce and Consumer Protection Committee, one of the three most powerful committees in the Senate along with the money and judiciary committees. It’s responsible for business regulation including insurance, banking, telecommunications, public utilities, licensing and consumer protection.

That has placed him at the center of another controversy: what to do about rising insurance premiums for condominiums. Unlike the HECO bill, however, the senator is pleased with the measure passed this session to help condo owners and associations get coverage.

Keohokalole, who is also co-chair of the Native Hawaiian Caucus, sat down with Civil Beat on Wednesday to talk about the session in general and the insurance crisis for condominiums in particular. The interview has been edited for length and clarity.

Let’s start with Senate Bill 1044, waiting for the governor’s signature. It’s been described as a landmark bill for condominium owners and associations as well as disaster resilience in Hawaiʻi. What would this bill do if it becomes law?

Hopefully by the end of the year, people who have been struggling with increased insurance premiums or who have lost access to insurance will have an alternative that is more reasonably priced than what’s available now through the foreign, unregulated market.

So bottom line, it’s a way for someone who has a condo to have an alternative to the insurance market, which, as you say, it’s been really in flux lately, right? Not just the rising premiums, but my understanding is they’ve been backing off on insurance coverage for hurricanes.

That’s right. And really what triggered the hurricane insurance crisis in Hawaiʻi, which is the biggest of the problems, was that several of the hurricane insurers pulled out or notified the Hawaiʻi Insurance Commission that they would not be taking new business and would be non-renewing some of their existing portfolio of residents.

There were four hurricane insurers and we dropped to three, and that really triggered the crisis, because the existing three could not, or would not, pick up the capacity of the fourth. So right there you have everyone who got non-renewed looking for options that don’t exist.

When did that happen?

Two years ago, post the Lahaina wildfires but not necessarily related to Lahaina. The more direct correlation is the fallout from the Surfside towers collapse in Florida (in 2021). That highlighted the need for aging buildings to keep up on their regular maintenance. The way I’ve been trying to explain it to people is, just like when you take your car in for service, a lot of times the mechanics will say you’re due for regular maintenance — 35,000 miles, you need a new timing belt, that sort of thing.

What we know is that at 30 years, many of these multi-story buildings need to have major infrastructure work done. The primary one is water piping. In some of these larger buildings its over a million-dollar job, and over the years, many condominium associations have been hesitant or haven’t had the means to conduct those regular maintenance items. And it’s been responsible for a lot of very expensive condominium claims across the country over the last several years.

And these charges are passed on as fees to the condo owners, correct?

Yeah. Essentially, if it was a home, they’d go out and take a mortgage and then assess the condominium unit owners through the association for their share of the mortgage payments to pay down the loan. Because these are self-run governments in these buildings, many of them have not done what the insurance companies see as regular maintenance items that need to be done. And it makes sense, if you think about — you know, a 15-story building where one of the units on the ninth floor gets a leak in the bathroom, and then it trickles down four floors, and then you have huge claims.

And that’s the textbook example of why insurers are so hesitant when it comes to aging buildings that have deferred maintenance. Fire sprinklers is another very complicated and tricky issue that’s been very cumbersome in Honolulu for condominium owners.

But at any rate, that’s really the major piece that caused the pullback from the insurers — that collapse in Florida and an overall look at building maintenance across the country with a focus on aging buildings. And the vast majority of condominium high rise buildings in Hawaiʻi are over 30 years old.

Is it still accurate to use that word “stabilization” in terms of what this bill will do for the condo insurance market?

Yes.

The bill is more than 13,000 words long. It’s almost like the budget bill in a way. It looks extremely complicated. How did you work through this?

The bill in concept is actually relatively simple, but insurance language and then condominium loan financing language is very cumbersome. There’s bond language in there, which is the most complicated stuff I’ve ever worked on in the Legislature. Over the interim, many members heard about this from their constituents. Often bills take a couple of years, just because the overall membership needs to sort of absorb and understand what we’re talking about here.

But fundamentally, the Hawaiʻi Hurricane Relief Fund was created after Hurricane ʻIniki (in 1992) because we couldn’t get hurricane insurance in Hawaiʻi. And that all makes sense. If you think about it, after ʻIniki and Hurricane Andrew, the hurricane insurers did the same thing. They pulled back, and people could not find hurricane insurance that their banks required them to if they had a mortgage.

The Hawaiʻi Property Insurance Association is our FAIR Plan (state-mandated Fair Access to Insurance Requirements program). It’s supposed to be our insurer of last resort. That organization has been running on a sort of a skeleton crew, just covering, for the most part, the lava zones. And so they’ve been trying to keep their overhead down and their costs low to accommodate that very small segment of the market.

So what we’ve done in the (condo) bill for those two entities is update the statute so that they can function in the modern era. One example with the HPIA is that there were caps on the property value of properties that they could insure — I think the cap was $400,000 or something like that. So we needed to update the statute, and then we needed to authorize them to spend the money from the hurricane fund to start offering policy.

The Hawaiʻi Hurricane Relief Fund was later deactivated. The bill essentially reactivates. It is that correct?

Sort of. There are provisions in the Hurricane Relief Fund that allow it to function autonomously. Essentially, they can draw down the funds. They can reconstitute themselves. But a lot of that statute was frozen in the 1990s, things like the caps on property value for eligible clients. We needed to fix that so that these more valuable properties are eligible.

This involves a condominium loan program and a revolving fund. Who runs that?

The Hawaiʻi Green Infrastructure Authority.

So, does this mean the state is getting involved in the insurance business?

We are getting back involved in the insurance business. And part of why the bill took two years, was we need to be very careful about doing that. You know, the state budget, I think, is $18 billion. I’m not sure $18 billion would cover Waikīkī (condo insurance).

And that’s where most of the condos probably are.

Right. So this is a statewide program that’s going to obligate hundreds of millions of dollars of state taxpayer funds. And if these policies are not appropriately configured and actuarially sound and professionally managed, then we could easily find ourselves after a disaster in the same situation as California is, where they are essentially assessing all property owners across the entire state to cover the losses from the those wildfires in Los Angeles.

We are trying to be as deliberate and discerning as possible. The policies offered by the Hurricane Relief Fund program do not need to be rated by the rating agencies by law, but we’re trying to go through that due diligence anyway. And the reason is, we are trying to attract back reinsurance. Those are the global financial entities that underwrite the risk for all the insurers so that they can offer more policies, but also de-risk themselves, so that if something happens they don’t go bankrupt.

Ultimately, you would not like Hawaiʻi to be the insurer of last resort, if you will. But you would like these companies that have moved away to have less risk, to take care of insurance and to come back and to come back, right?

It’s not an insurance policy of last resort. There’s language in the bill that authorizes the hurricane fund and the HPIA to set some pretty strict conditions on the policyholders to ensure that they are on a rehabilitation plan to bring themselves back into compliance with their maintenance.

You can only participate in the program for five years. And both insurers are authorized to set conditions. They’re authorized to go in and inspect properties and work with the association, sort of like the approach of the Hawaii Employers Mutual Insurance Co., to work with the associations to get on a rehabilitation plan.

We’re trying to make sure that the hurricane fund is focused on the residents that really need it the most.

The condo loan program is intended to work somewhat like a pilot, because that’s not enough money, really, to get us where I think ultimately we need to go. But it was intended to work as a pilot project to see if we can both provide access that’s hopefully cheaper than the surplus unregulated market, but also get these buildings on the path to solve their deferred maintenance.

And then meantime, the state insurance commissioner is going to study a way to develop something long term for stabilization. That’s part of the bill as well.

Yeah, because the environment is dynamic and policies are offered annually. Buildings are coming up for renewal continuously. And every time we meet with the insurance people, the environment changes a little bit. And so the idea with the study is to allow the state Insurance Division to get a better handle on what is going on right now so that we can make more reasonable decisions. You know, there’s a risk here that if the program works too well, we will run out of money really quickly and we won’t be able to cover all of the people who deserve help or who want it.

Anything else I’m missing on the condo bill before we move on?

We’re trying to make sure that the hurricane fund is focused on the residents that really need it the most, and not open up the program with no conditions and then suddenly have luxury condos in Kakaʻako sapping up all the capacity because it’s cheaper. And so the challenge with that was we also want to make these programs available as quickly as possible, and so there are some caps in the program. But the hurricane fund has been working with the reinsurers and with us to make sure that we’re tailoring it appropriately, so that we can both go fast and offer programs that are simple but also focus on the people who really, really need it.

If the bill does become law, when does eligibility begin?

We are told that the hurricane fund is close to ready. I’m confident that we should have a program available to homeowners before the end of the year. I’m confident the governor will sign it. He essentially used an emergency proclamation after the bill died last year to reconstitute the hurricane fund so that they could get going in tandem with the bill, which is why they are hoping to be ready by the end of the summer. I’m hoping that we have something by the end of the year.

Let’s talk about invasive species, in no small part because your district, which includes Kailua and Kāneʻohe, has really started to see the little fire ants, the coconut rhinoceros beetle and more. There is an omnibus bill that is going to do a number of things — new positions for the Department of Agriculture, increased funding for the department, which will now be the Department of Agriculture and Biosecurity. Is this enough? Did the Legislature really make a major step forward with invasives?

No, but it’s important. It was a necessary step, for sure, and it’s a big deal.

Why is it a big deal?

Because we restructured the legal authority. The Department of Agriculture had essentially given up on many of these species. They had given up on coconut rhinoceros beetles, and we are making them try again, to the frustration of a lot of people who are seeing what’s happening. But one of the most frustrating excuses we got from them is that they didn’t have the legal authority to go after bad-actor nurseries or to crack down on importers or exporters who we know are spreading or selling infested products to the public. And so this makes it crystal clear that the Department of Agriculture has the authority that almost every other state has to go in and do whatever is necessary.

You mean like raid a nursery, saying, “We understand you’ve got little fire ants in your plants.”

Well, yes, but it doesn’t need to go as far as a raid. It can be as simple as “stop selling these products until you have treated them appropriately, and we’ve inspected to make sure that you have.” Up until last year, the Department of Ag denied having the authority to do it. I disagreed, because I thought it was in their 100-year-old statute. But that was the bureaucracy coming into play. And so by restructuring the department in this way, they have, you know, the “strike force capability.” Now, essentially, they can just go in and just shut it down.

That’s what they do in the state of California. And they do press releases all the time — “We found a new beetle in the avocado industry” — and they will go in and they will just halt production and sales in the one industry until they have a handle on it, because they take it that seriously over there.

And I do think it has negative repercussions for Hawaiʻi when we have this reputation of being, you know, a regulatory backwater without the authority or the willingness to go in and work with the industry, but when necessary to tell the industry what needs to happen, even if it’s to their detriment.

I think it was Rep. Kirstin Kahaloa who came up with the idea for the renaming of the department. But that’s not cosmetic — the word “biosecurity” — to you, is it?

I think it goes hand in hand with the legal change. So for me, the biggest part is that we have restructured their legal authorities. They no longer can make up bureaucratic excuses like “we don’t have the rules to do it” or “the statute isn’t clear,” or any of that kind of rubbish.

The department was not moving swiftly enough. I have real suspicions about whether they are at this point, and so that’s why I think the bill is important.

What I want to prevent is a future Department of Agriculture director or administration giving us the same excuses, that “we don’t have the authority to do what’s necessary.” That’s done, and we are going to be happy in 10 years, in 20 years, that we did that right.

Senate Bill 897 also awaits the governor’s action. It’s described as a bill — this is our reporting — “to help shore up” Hawaiian Electric Co.’s credit rating. But of course, it was opposed by not only you, as chair of the Commerce and Consumer Protection Committee in the Senate, but your counterpart, Scot Matayoshi in the House, who actually worked very much on the bill.

As I understand it, it would impose a new fee on Hawaiian Electric customers to help pay for investments needed to protect the public from wildfires. But the main concern is that there was this 11th hour amendment coming in suddenly regarding liability for the utility for property damage in the event of a future wildfire. These are the words you said on the Senate floor — this is right near the end of session — “It’s a blatant corporate handout.”

It’s now been a month or so since then. How are you looking at that in retrospect?

I’m still frustrated about it.

Tell me about that.

Well, I think I laid out my primary concern in the speech. This option to create a shield that would provide legal immunity to Hawaiian Electric for a period of time could potentially immunize them from responsibility for multiple fires, and that concept was never discussed during the session, and has not been proposed in any other state, and it is deeply concerning.

This was done in a conference committee, so the public had no chance to weigh in at all.

Yeah. And so part of what’s frustrating is we put a tremendous amount of work into the liability protection above a certain amount for the next fire. Now, what I’ll also tell you is what was originally posed by Hawaiian Electric was the super fund concept, which is the utility is responsible for damages caused in an event above a certain amount, and then they would pay into a fund that exists above that amount. If there are damages that victims are not going to be made whole for because they hit the cap, there’s this pool of funds available.

That’s basically the way nuclear power plants are because nuclear power plants could not get insurance. No one would insure them because a nuclear disaster is catastrophic, uninsurable. So the federal government created this super fund model where all of the nuclear power plants across the country, all of their contractors, they all pay this fee into this superfund. And if there’s ever a disaster, the plant itself is responsible for up to X amount. And then if victims still are deserving of compensation, they draw from the super fund.

That’s what was proposed by HECO. What passed was a directive to the Public Utilities Commission to propose either a cap or a period-of-time cap, with no fund. So if they were to approve something, we would either need to come back and do a fund, or there would just be no outlet, which is a model that doesn’t exist anywhere and is the type of thing that happens when you put stuff in (a bill) at the very end (of session).

I don’t want to stay too long on this bill, but something that Matayoshi said — “the securitization part of the bill is fantastic.” This is where HECO can borrow money against these new fees to customers, then pay for wildfire prevention initiatives. Is that something you also support in this bill?

I support the concept of it. What I would like to see is HECO make a public statement and say that they’re actually going to use it, because HECO did not ask for that at any point in the process. That part was inserted, and we are essentially shoving it down their throat. They wanted to use securitization to fund that super fund. And so that was dismissed out of hand pretty early on the House side, and there was a lot of concern about it on the Senate side. I was not opposed to it because, again, we were very focused on this liability issue, because it’s a real issue that we do have to do something about.

I just think that the scope of viable solutions on that has now just been blown wide open in favor of the utility in a way that’s really troublesome ultimately. I mean, the PUC has to go through a public proceeding that’s going to take probably two years, and I’m going to ask that they conduct hearings on the neighbor islands, because when they did rulemaking the last time they had hearings on the neighbor islands as well. My concern might end up getting addressed (by the PUC), and if HECO is ultimately going to use securitization to do their wildfire mitigation plan, then that is the best deal possible for the ratepayers.

You’re co-chair of the Native Hawaiian legislative caucus. As you know, the Department of Hawaiian Home Lands didn’t get those additional funds it was looking for. It wanted, initially, another $600 million to spur lot development. That didn’t happen. There was also a bill to increase the hotel tax to bring steady income to DHHL. That is also dead. For the Office of Hawaiian Affairs, they couldn’t get that deal through Kakaʻako to build residential towers.

Here’s a quote from Daniel Holt, the representative who leads the House Native Hawaiian Affairs caucus. He said, “It seems it just seems to be a pattern of Hawaiian issues just not being at the forefront for the majority of our colleagues.” Response?

It’s always frustrating when you can’t get bills that are priorities through, and so there’s nothing different about that in the Native Hawaiian context, except that there’s so much riding on it. And obviously Daniel and I feel very well responsible.

There’s 28,000 people on (the DHHL) waitlist.

And the overwhelming majority of them are Baby Boomers. And so my biggest fear is that that list will shrink by people dying faster than it’ll shrink by them getting homes.

This seems to me not just an affordable housing issue but it’s also justice for Native Hawaiians. I mean, this is something that is a federal mandate essentially.

Daniel and I wrote an op-ed (for Civil Beat) after the casino bill (for DHHL) went down, which we proposed, because it was right after the pandemic when we were in a bad situation with the budget.

We did the $600 million bill in 2021. We were in bad shape from a budget standpoint and Covid, so we proposed the casino, and I’ve never been beat up worse. Daniel will probably tell you the same, but the idea was that we didn’t have money, and so we needed to figure out some sort of way to get the money to build homes.

What we said in the op-ed was that this was a condition of admission into the union. So you could say it’s a federal mandate, but it was the deal we struck as the people of Hawaiʻi to get ourselves a star on the flag. We’re going to take on the responsibility of the Hawaiian Homes Commission Act. And so for the people on the waitlist or their family who are looking at the star on the flag going, “Oh, we got a raw deal,” they’re absolutely right.

And do I wish that more people would take on the chair of the Hawaiian caucus and then would advance these kind of bills year over year? Sure, but that’s something that Daniel and I committed to do in the meantime, because you can’t wait for anybody else to do it. So yeah, this was not a great year for Hawaiian issues. It was frustrating. You can’t win them all, but we certainly would like to have done better.

Is Kali Watson making progress as director of the DHHL?

I think Kali is doing a good job. The thing I like most about Kali is he’s aggressive and I think that’s what we desperately need. I think he sees it the same way, which is that there are a lot of people on that waitlist, and we need to do something about it before they die.

I think his developer background is helpful. I think more helpful is that he was the administrator before so he knows how to be more aggressive than is appropriate and still get away with it. I’m not talking about breaking any laws, but he knows how to go as fast as possible.

But he’s also managed to mostly escape the the ire of the Legislature, in part because he’s trying to go very fast, right? Sometimes there is concern about whether the plan is changing too rapidly, and whether that’s going to end up putting us further back than if we had just stuck to the original plan.

But in general, yeah, I think Kali is doing the right thing. I think it was the right thing to ask for more money. And he’s under his own microscope. They need to deliver homes. I don’t build the homes, he does, and he knows that, and the more homes he builds, the easier it’s going to be for us to try and help him.

Last three questions. You graduated from the UH Richardson Law School, but what was your B.A. in?

Journalism.

Ha! Loser. Why did you decide to go into to public service and politics?

This is going to sound so self righteous: I didn’t like having to report both sides. It made me realize I was an advocate. I wasn’t an observer.

Got it. Very revealing. Two other things — what are you hearing from constituents these days?

In general, I think there’s a lot of concern about public safety. You know that 400-police officer shortage, I think, is troubling. I think the perception of a revolving door for petty crime is a challenge. I think a lot of people are upset about Trump. I mean, I hear that a lot too, especially on social media.

A good chunk of your district actually did vote for Trump.

Sure, yeah.

What is the the main concern about the president?

We’ve been going around talking to people about how we might have to hold out for a special session and we needed to act prudently with the budget this year, because we need to make sure we have something available if they were to do something catastrophic, like cut Medicare or Medicaid. I think mostly people have responded well to that, because it’s reasonable.

That’s kind of like with the insurance thing. I do feel a really strong responsibility not to break anything. Lives and livelihoods are at stake is the way it’s been described here. And so it’s really important to approach this stuff intentionally and professionally. I think that’s kind of why I was upset about the HECO thing.

On HNN’s “Spotlight Now” on Tuesday, the latest from the governor is that a special session will probably be in October, because that’s after the feds have to get their budget done. Is that kind of what you’re hearing?

So for me, the thing I am keeping an eye on is Medicaid. It’s a huge part of our budget, and it impacts tens of thousands of people — not just their livelihoods, their lives. And so if something of that magnitude happens federally, then we’re likely going to be forced to take action. Now, we’re state legislators. So if the governor calls us back into a special session, we come as senators. We come during the interim, every year, anyway, periodically, (to confirm) judges or whatever else.

So that’s just a part of the job that we’re going to stay ready for. Should it come? I do have a concern: We need to come in with intention, and we need to run these things nice and tight, because it’s really expensive to hold a session.

Civil Beat’s reporting on the Hawaiʻi State Legislature is supported in part by the Donald and Astrid Monson Education Fund.

Sign up for our FREE morning newsletter and face each day more informed.

Sign up for our FREE morning newsletter and face each day more informed.

Read this next:

Danny De Gracia: The Case For Young People To Stay In Hawaiʻi

By Danny de Gracia · June 9, 2025 · 8 min read

Local reporting when you need it most

Support timely, accurate, independent journalism.

Honolulu Civil Beat is a nonprofit organization, and your donation helps us produce local reporting that serves all of Hawaii.

ContributeAbout the Author

Chad Blair is the politics editor for Civil Beat. You can reach him by email at cblair@civilbeat.org or follow him on X at @chadblairCB.

Latest Comments (0)

As a condominium owner, I thank Greg for his well-written response below that SB 1044, on reinsuring condo insurers, will not help most condominium owners, and that proper maintenance of all aspects of a condominium is not to be optional or deferred.I want to add that those professional condominium insurers; condominium management companies and State of Hawaii who insures both to do business, along with the volunteer board directors are the ones responsible for these huge increases in the insurance portion of our monthly maintenance fees and special assessments for the last three years should be addressed and returned to every condo owner affected.

mycivilbeat · 1 month ago

As someone who owns and operates two condosâone for living, one for my 24/7 businessâIâve seen my insurance premiums quadruple in just a few years with no claims filed. This isnât market fluctuation; itâs a market failure. I donât always align with Chad Blairâs takes (his reporting often feels more like commentary), but I give real credit to Sen. Jarrett Keohokalole. He listens. He leads. And heâs tackling a mess most would rather avoid. The condo insurance rescue bill he helped move forward is complicated, yesâbut itâs thoughtful, grounded, and aimed at helping everyday people, not luxury towers. Thatâs the kind of local leadership we needâespecially from someone who understands both policy and community. Mahalo, Senator.

Thanks · 1 month ago

Chad, thanks great article your report (expose) inspired the positive and negative about HECO, our Legislators, and a few related issues causing thought, its a CB thing.

Moilili · 1 month ago

About IDEAS

Ideas is the place you'll find essays, analysis and opinion on public affairs in Hawaiʻi. We want to showcase smart ideas about the future of Hawaiʻi, from the state's sharpest thinkers, to stretch our collective thinking about a problem or an issue. Email news@civilbeat.org to submit an idea.